ASCN Case Study: User Avoided Scam and Saved $2000

about cryptocurrencies.

ASCN Case Study: User Avoided Scam and Saved $2000

Today we'll tell you how our client avoided a scam with the help of ASCN and didn't lose $2000. You'll learn how to use ASCN to check a token for scams and save thousands and tens of thousands of dollars. Let's go!

One of the ASCN users was looking for altcoins with small market capitalization for investment. He found the BTC Bottom token and decided to analyze the project with an AI assistant before purchasing. In ASCN, the user asked: "I want to buy the BTC Bottom token.

Check: is this a scam or not?" To which the AI provided an entire list of red flags and asked for additional information to conduct the analysis

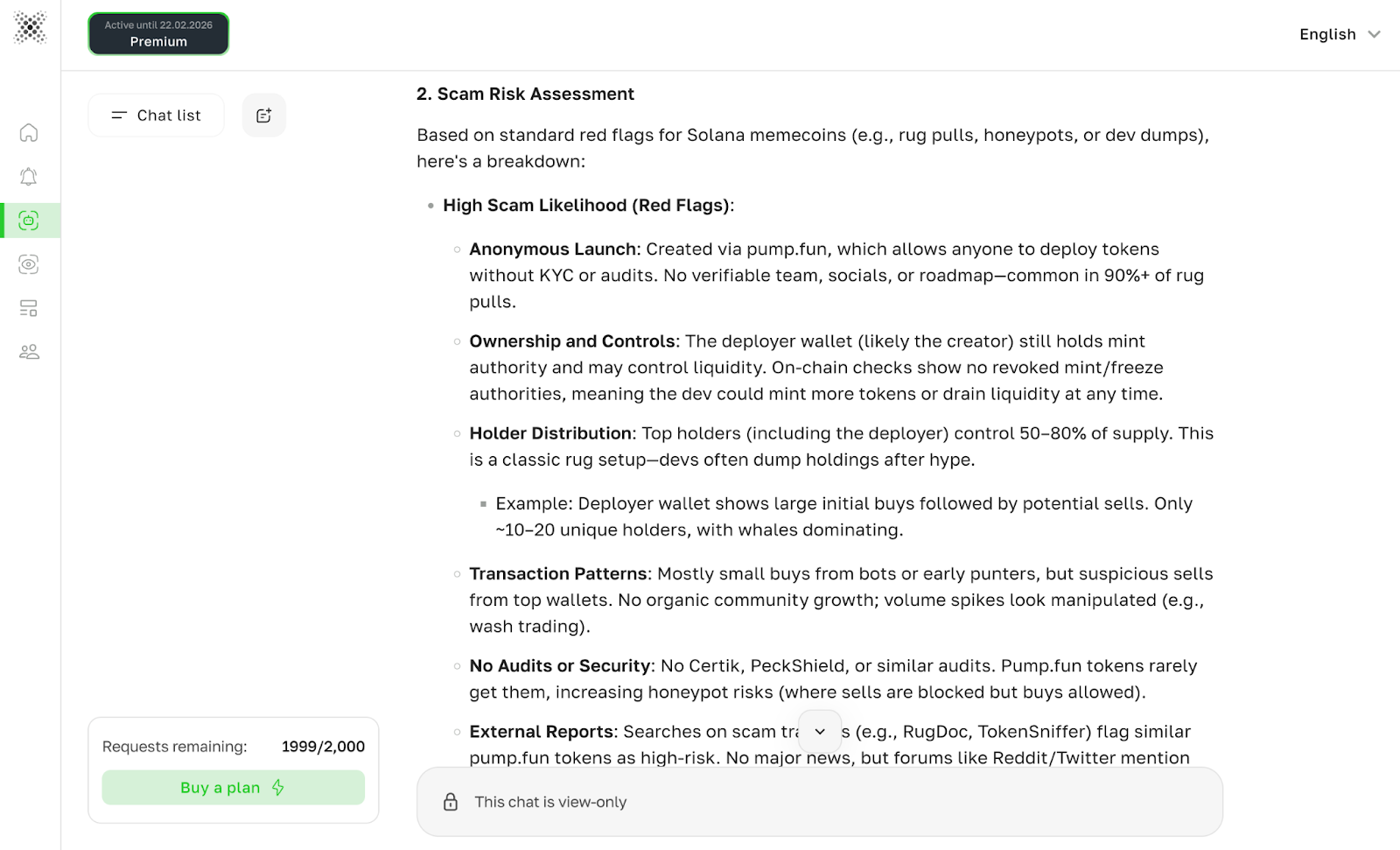

Next, the user asked the AI to analyze the smart contract, check the liquidity, and give a final assessment of the token: is it safe to buy or not. One by one, he entered requests into the AI: "Analyze the contract: honeypot, mint functions, taxes, ownership" then "Show the holder distribution: is there concentration among the developers?" And "Check the liquidity: is it locked or not and to what extent?" And finally asked for a summary: "Give a final assessment: is it safe to buy the token?"

Next, the user asked the AI to analyze the smart contract, check the liquidity, and give a final assessment of the token: is it safe to buy or not. One by one, he entered requests into the AI: "Analyze the contract: honeypot, mint functions, taxes, ownership" then "Show the holder distribution: is there concentration among the developers?" And "Check the liquidity: is it locked or not and to what extent?" And finally asked for a summary: "Give a final assessment: is it safe to buy the token?"

ASCN checked the contract and found a honeypot vulnerability, in which an investor can buy the token, but when selling, the smart contract will block the transaction, so the investor won't be able to sell the purchased token.

Also, the AI determined that 45% of the tokens were concentrated in the developers' wallets. Normally, a team holds no more than 5%-10% of tokens. Thus, 45% is already a red flag, since the developers have the ability to sell their tokens to the market at any time and crash the token price. Also, the token's liquidity turned out to be unlocked.

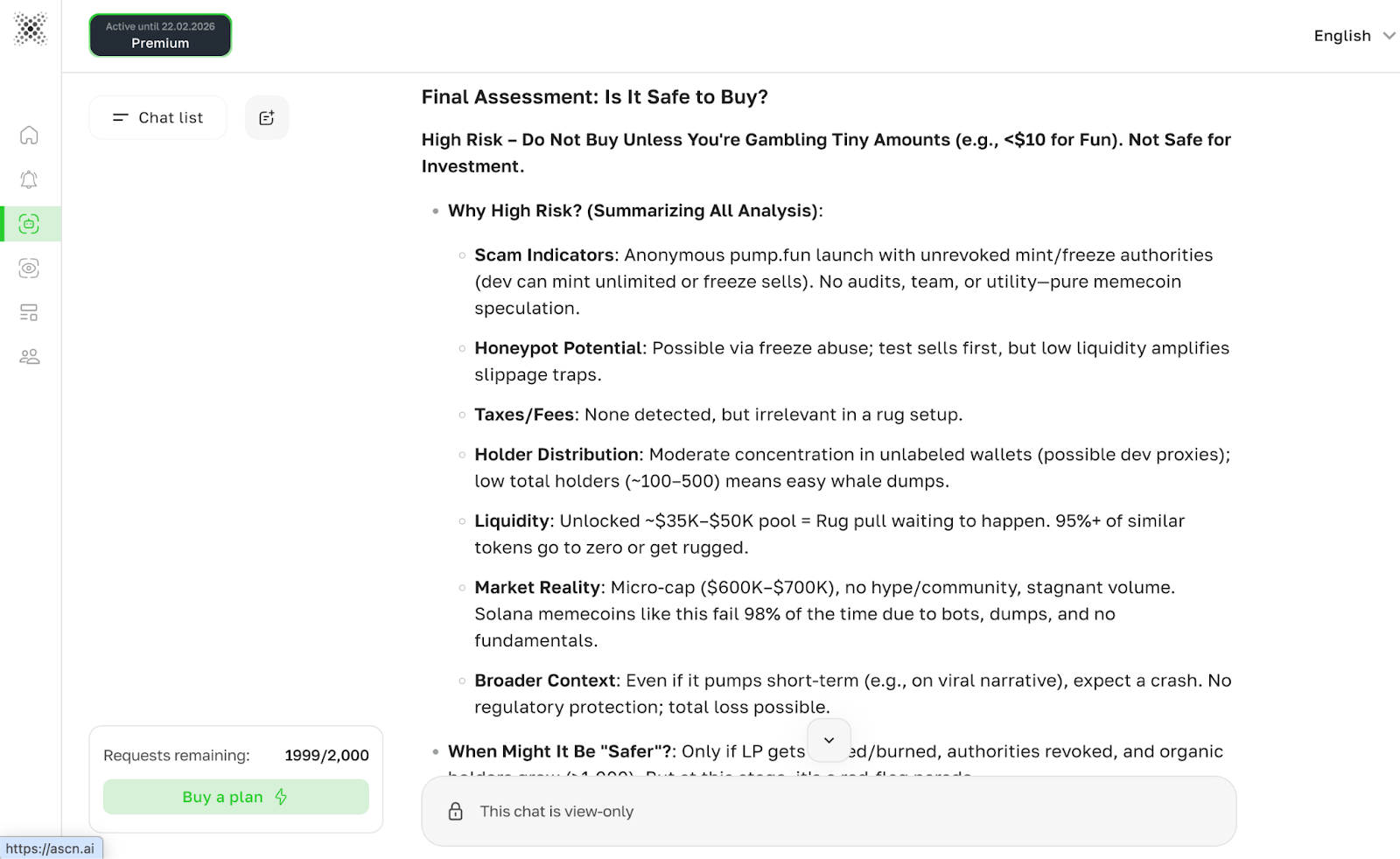

This means that the project team has access to all the funds that investors invested in the token. In normal projects, liquidity is locked, preventing developers from taking users' money, but with unlocked liquidity, developers can withdraw tokens from the pool, thereby executing a rugpull. The token price will crash 80-100%, and users will be left with tokens that are worthless. The team will quickly delete the project's social media, website, and any mentions of the project. This is a typical rugpull scenario. ASCN indicated that the BTC Bottom token had a large number of red flags and would very likely turn out to be a scam. And this prediction turned out to be true. The user wanted to buy the token for $2000, but decided not to. Just a week later, the project team executed a rugpull, and the token price dropped by -98%.

ASCN indicated that the BTC Bottom token had a large number of red flags and would very likely turn out to be a scam. And this prediction turned out to be true. The user wanted to buy the token for $2000, but decided not to. Just a week later, the project team executed a rugpull, and the token price dropped by -98%.

Thanks to ASCN's analysis, the user did not invest in the scam and saved $2000. ChatGPT and other LLMs would not have been able to conduct such an analysis because they do not have access to blockchain nodes. Usually they analyze projects based on news, but news is typically written after events have already occurred, and it's simply impossible to learn about an upcoming scam or rugpull through ChatGPT. Thus, the user checked the smart contract of the token he doubted through ASCN and it turned out to be the right decision, which helped him save $2000.

ASCN analyzed the token distribution, checked the liquidity, found honeypots and backdoors, and advised against investing in BTC Bottom. You can repeat the analysis with any token that interests you and save thousands of dollars by avoiding the scams that lurk around every corner in crypto.

You can read the full chat history of the user here: https://ascn.ai/ru/ai/share/d2177426-e6fb-410a-93c5-43982228a492